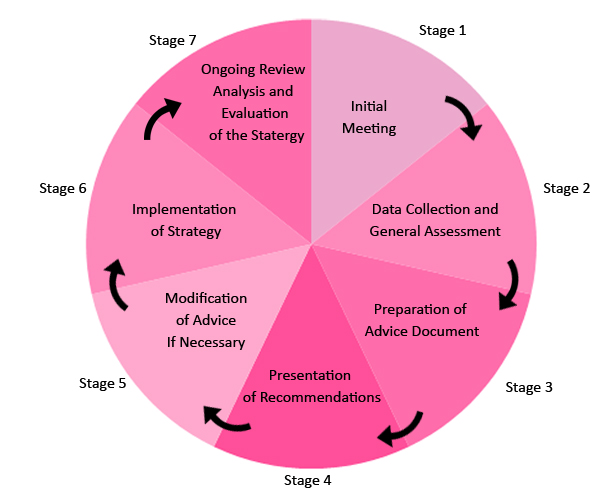

The financial planning process involves a number of steps.

These steps are noted below:

Some of the major reasons that people use the services of a Financial Adviser are to:

In constructing an investment strategy to meet the objective of the individual, a number of factors are taken into account.

These are:

Life insurance provides financial protection and peace of mind for individuals and their families. In the event of the death and disablement of the life insured, it provides financial benefits to enable families to cope better. It can help cover essential living expenses, support children's education, and allow families to maintain their standard of living when the main income earners are not able to work or have died.

For many, life insurance acts as a crucial safety net, offering stability and security when it's needed most. Life Insurance provides benefits in the following scenarios :

Estate planning is the process of arranging and documenting how your assets, finances, and personal wishes will be managed and distributed if you become incapacitated both before and after your death. It typically includes the creation of a will, superannuation death benefit nominations, appointing enduring powers of attorney and guardianship, and making decisions about medical treatment through an advance health directive. The goal is to ensure your wishes are respected, to reduce stress for loved ones, and to avoid legal complications.

The components of Estate Planning broadly speaking comprise:

Reasons to have a will include: